How to Best Manage Channel Conflict (and How to Prevent It)

Channel conflict can be lethal to your sales, but these tactics and real-life examples show you how to overcome it.

Some of the most well-known and purchased brands out there leverage multiple distribution channels. Nike, for example, balances selling direct-to-consumer through their ecommerce store with selling through retailers (such as Amazon, Nordstrom, and Foot Locker).

This is no small feat. Multiple channels increase the chances that manufacturers, buyers, retailers, and your brand conflict.

Nike manages it…but most brands aren’t Nike.

So, how can fast-growing brands, with less brand recognition and tighter margins, introduce channels without also introducing loads of conflict?

In this article, we look at:

- What channel conflict is and how it can impact your business

- The most common forms of channel conflict

- Notable pros and cons of adding new channels

- 4 strategies for preserving channel relationships

- Firsthand accounts from three ecommerce brands

No time to read?

Get the highlights in 10 minutes.

What is channel conflict?

Channel conflict is when two or more partners in a sales channel oppose each other. For example, when a retailer goes directly to a manufacturer to launch a copycat product.

To get a clearer picture here, let’s back up for a minute.

A channel is a means of distributing your product. This includes:

- Selling direct-to-consumer through your website

- Selling to consumers in your brick-and-mortar store

- Partnering with physical retailers (Target, Walmart) to sell in chain stores

- Partnering with online retailers (Amazon) to sell in an online marketplace

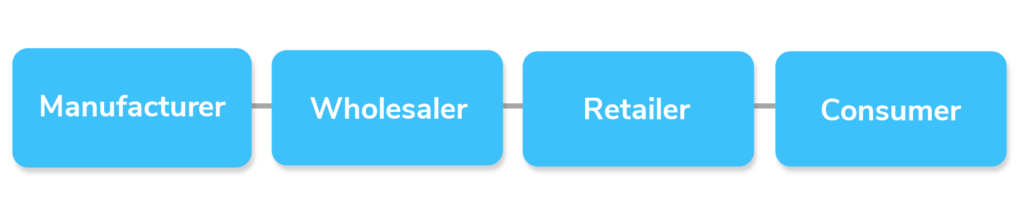

Channel partners are the different parties working together to make, list, and distribute the product. A channel partner is often a manufacturer, wholesaler, retailer, reseller, or consumer.

Channel conflict is when two or more of these partners are at odds.

What is the upside to managing channel conflict effectively?

Harry’s managed to disrupt the men’s grooming industry with a multi-channel strategy.

While they started as an online-only shaving subscription service, they’ve since turned into a massively successful men’s grooming brand. Today, they sell their products through a DTC ecommerce store as well as in various big-box retailers such as Target and Walmart.

What’s more, Harry’s has largely avoided channel conflict. By maintaining a standard price for their products across all sales channels, they circumvent any price competition between the retailer and manufacturer.

But given all the benefits of DTC, why do brands like Harry’s bother with other channels to begin with?

They bother because there are many upsides to adding channels:

- Rapid growth potential. New channels let you tap into additional audiences and volume overnight. Higher volumes can mean manufacturer discounts, which improve your margins. While you can drive high volume with a large DTC presence, partnering with a retailer is a faster, more approachable option for many brands.

- Authority by proxy. Simply appearing on Nordstrom, Target, or Walmart’s shelf can communicate credibility to shoppers. Consumers think, “Hey, they’re in Walmart, they must be a legitimate business.”

- Access to ‘offline’ shoppers: You’ve seen the stats around the massive growth in ecommerce. But even after the pandemic, not everyone wants to shop online. Working with retailers gives you access to the “offline” customer base.

- Customer convenience. Many consumers still want the convenience of popping in a store and getting an item now. Or, they want the option to easily try and return an item. When you work with a retailer, you provide convenience for customers in both of these scenarios.

- Share of mind and wallet. You’re present on the shelf during weekly store runs, and you’re present in the retailer’s shopping app when the consumer puts together a curbside pickup list. Both of these give you ‘free’ advertising. You’re regularly popping into the customer’s mind each time they shop.

Marquis Matson, Content Marketer for RugPadUSA, explains, “Big Guys like Amazon simply make it easier to be found. If our site cannot compete with a site like Amazon, then it’s better to list our products there instead of hoping that customers find us organically.”

RugPadUSA relies on DTC, as well as Amazon, Wayfair, Walmart, eBay, Overstock, and others. While working with those giants has drawbacks (including environmental and social impact), Marquis notes “these corporations are helping small businesses by footing the marketing and admin bill, while our small business can continue focusing on the business itself.”

However, the math isn’t as simple as product + channel = profit. It’s a bit more complicated than that.

Why is it (potentially) bad for business?

While the benefits of additional channels are notable, so are the costs.

The perils of adding channels include:

- Lower margins. There’s no higher margin than a direct-to-consumer owned sale, which is why many brands launch DTC in the first place. While adding channels does have benefits, one of the biggest costs is lower margins.

- Costs of getting in the door. Breaking into a channel — whether it’s Walmart, Nordstrom, Target, or Amazon — is hard and expensive. Sourcing and vetting partners often means hiring a lawyer or specialized service to review contracts, and the costs of this further erode margins.

- Contracts that strongly favor retailers. Speaking of contracts, those aren’t guaranteed to be in your favor. On a Drive and Convert episode, Ryan Garrow (Director of Partnerships at Logical Position) talks about a friend’s experience with a massive drugstore chain. As part of the friend’s contract, the chain could throw away or severely discount the brand’s product — not to mention the brand was responsible for buying back any product the retailer didn’t sell! Yikes.

- Logistical complexities. Imagine having to get your product in bulk to a thousand retailers, on the same day, with product that has the same sell-by date. This is a major logistical hurdle and, again, the costs add up quickly.

- Poorer customer data. When you add a non-DTC channel, you inevitably lose control over customer data. For example, who is purchasing your product gets a lot fuzzier.

- Confusing customer maps. You also introduce “customers” who aren’t the end-user of your product, and this creates a complex map of who’s buying and using items from your brand. (In some scenarios, your customer may even be a competitor.) This can make improving — not to mention tracking — lifetime value very tricky.

- Compromised customer experience. Partnering with a retailer means giving up some control over the customer experience. There’s no way you’ll visit thousands of retailer locations to ensure your product is being displayed correctly. And even if you pop into one store and notice an issue, what do you do? Ask for the store manager and say, “Hey, I own this product, and I need you to make these changes…?”

Unfortunately, that’s not an exhaustive list. There are additional downsides like oversaturation, price wars, and turf wars (more on these just below), which can all have big impacts on your business.

What are the different types of channel conflict?

To prevent or manage channel conflict, you’ll want to understand the different types, plus strategies for preventing or addressing them to begin with.

How does channel conflict come about?

Before we get into strategies, let’s look at a normal distribution flow and the different types of conflict that can occur in distribution channels.

In the image below, each layer of the flow is dependent on the next. Meaning, even the slightest disruption to this process can create conflict throughout the entire distribution network.

Conflict can be vertical, horizontal, or across multiple channels.

Vertical conflict, horizontal conflict, and multiple channel conflict

The most common form of channel conflict is vertical channel conflict. This is when two parties at different points in the distribution channel (e.g. a manufacturer and a retailer) have a dispute.

Causes of vertical conflict can include:

- Direct and Indirect Sales. You’ve heard of retailers going directly to a manufacturer to launch a cheaper or “copycat” product, right? That’s a source of vertical channel conflict. When one party sidesteps another to sell direct-to-consumer, you get competition between manufacturers and retailers.

- Oversaturation. When manufacturers allow too many retailers in a given territory to sell their brands, you have oversaturation. This ultimately hurts sales and creates fierce price competition for retailers

You can also have horizontal channel conflict. This is when two parties at the same level in a distribution channel (e.g. two retailers) are at odds.

Causes and results of horizontal channel conflict include:

Loss leader and price wars. Sometimes, one member of the distribution channel significantly lowers the price of a product to drive traffic to their store. (Retailers often use this tactic to bring people into their store.) Then, they upsell more expensive products to customers to make back the margin they lost on the initial discounted product. This creates conflict with other retailers — it pressures them to adjust the pricing of the same product, even if it will have a substantial impact on their profit margin.

A common result is a price war. Even if you don’t directly participate in this war, it has negative effects on your brand:

- Devaluation: It trains customers to expect a lower product price, which devalues the involved brands and products.

- Stagnation: Prospects may hold up on a buying decision and wait for the price to drop even lower. This can lead to sales stagnation.

- Higher return rates. Those who have already purchased your goods may feel cheated when they see lower prices. This can lead to higher return rates and degradation of your brand.

Turf war. Price wars bleed into turf wars, which is when multiple wholesalers or retailers are selling in the same territory. Manufacturers may appoint a few wholesalers to the same region or city, but if territories aren’t properly set, wholesalers will be battling for sales in the same territory. As a result, brands get caught in a war they can’t participate in — their “soldiers” (products) are moved around without you.

Lastly, there’s multiple channel conflict. This occurs when a manufacturer has at least two channels competing for sales of the same brands/products. For example, a manufacturer may be selling their products direct-to-consumer (D2C), while also selling to a wholesaler/retailer. This creates conflict because the manufacturer and retailer may be selling the products to the same markets, but at different prices.

What is the most commonly cited source of channel conflict?

Amazon is its own beast. Selling there involves spending time and resources on:

- Understanding the channel

- Creating channel-specific product content

- Regularly optimizing for the channel

- Forming a relationship with Amazon

Let’s take one of the most expensive pieces of that list: ads.

Ryan Garrow notes his budget on Amazon ads is five times what is on Google. And that’s just the money piece. There’s also the fact Amazon is a different ballgame. Both Amazon and Google have algorithms. But where Google’s ad algorithm is more defined, Garrow notes Amazon’s “is strange. It takes time and a lot of failure to figure it out.”

In short, Amazon is a unique channel. But ecommerce founders are up for challenges. Some brands have developed equally unique ways to leverage Amazon that make it worth the effort.

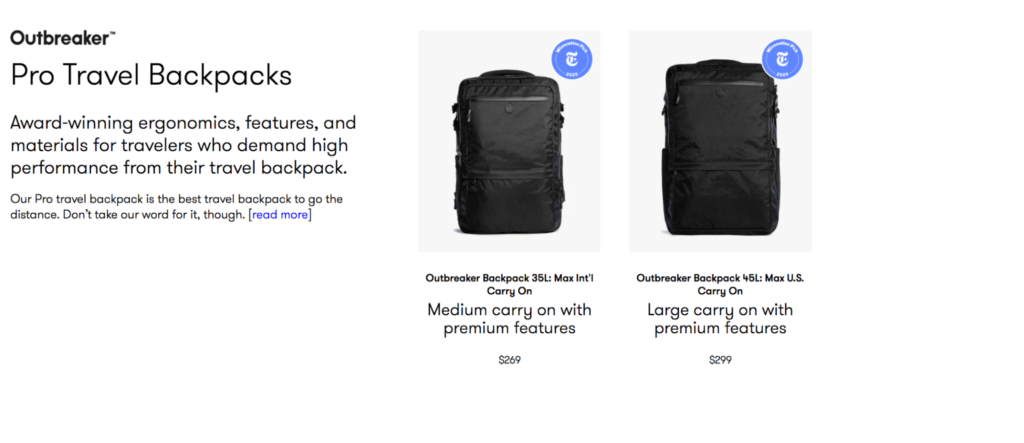

How Tortuga Backpacks uses Amazon to move inventory

In non-pandemic times, Tortuga Backpacks uses Amazon to move the remaining inventory for discontinued or updated products. So, they’ll list version 3 of an item at full price on their DTC website and version 2 (the older version) for a lower price on Amazon.

This approach has a few benefits. It:

- Reduces confusion on tortugabackpacks.com because new and old versions don’t appear side-by-side

- Avoids direct competition of the same SKUs

- Maintains a healthy liquidation margin, despite Amazon’s fees

- Allows Tortuga to cater to an additional audience with a lower price point

Fred Perrotta, co-founder and CEO of Tortuga Backpacks, explained, “We can also offer the [Amazon] link to people who email us asking for discounts or saying they want a Tortuga but can’t afford it.”

How to know when a new channel is worth the risk of channel conflict

There are plenty of pros to adding channels…and there are plenty of cons and potential conflicts, too. How do you decide when adding a channel makes sense for your brand?

There’s no easy answer here. However, adding a non-DTC channel could make sense if you can check the following three boxes:

- It’s good for the customer. We often speak with clients whose primary concern is sales. Others are worried about offending their distributors. But those aren’t the best way to frame your channel approach. Our philosophy is that every decision should begin with concern for the customer. When customers are pleased, demand is high and sales are good. Never lose sight of who really provides paychecks for your staff and employees. By developing that mindset in all you do – including your agreements with retailers and others in your distribution system – you’ll all have the same goal in mind. When the customer is happy, every part of every channel works better.

- You have the time and resources to invest. Whether you’re eyeing Target shelf space or a listing on Amazon, you’ll need time and resources to break in, understand the channel, and manage a contract. Something else to keep in mind: any time and resources you’re pouring into adding a channel is time and resources you’re not pouring into some other aspect of your business (i.e. there’s an opportunity cost). Make sure that’s a trade you’re willing to make.

- You have a strong DTC brand. The stronger your brand and customer base, the more leverage you’ll have when you negotiate contracts. Think of it this way: When a retailer partners with you, they’re placing a bet that your product will sell. If you can minimize how risky that bet is, you can secure better terms for your brand. And the best way to minimize that risk is to have an established presence with strong sales.

Let’s say you do check these boxes and decide to pursue an additional channel. How do you avoid those nasty vertical, horizontal, and multi-channel conflicts?

Enjoying this article?

Subscribe to our newsletter, Good Question, to get insights like this sent straight to your inbox every week.

4 strategies for preventing channel conflict

Below are two high-level recommendations and two specific tactics for preventing channel conflict.

Let’s look at the high-level approaches first.

1. High-level: Build leverage for a watertight contract

As we mentioned earlier, building your DTC brand before adding a channel helps you negotiate better contracts. And when you can negotiate a watertight contract, you can better hedge against the potential cons of adding a channel — poorer customer experience, lower margins, and contracts that favor the retailer.

Build leverage (aka a strong brand consumers want) and gain more control over the narrative of what, where, and how your products are sold through retailers.

2. High-level: Start small, then ramp up

If this is the first time you’re working with a retailer, don’t go “all in” from the start. Instead, start small, negotiate strong terms for that start, and then ramp up if you experience success. Once you do that, there are tactical ways to thrill customers by participating in direct sales – without angering or alienating your distributor base.

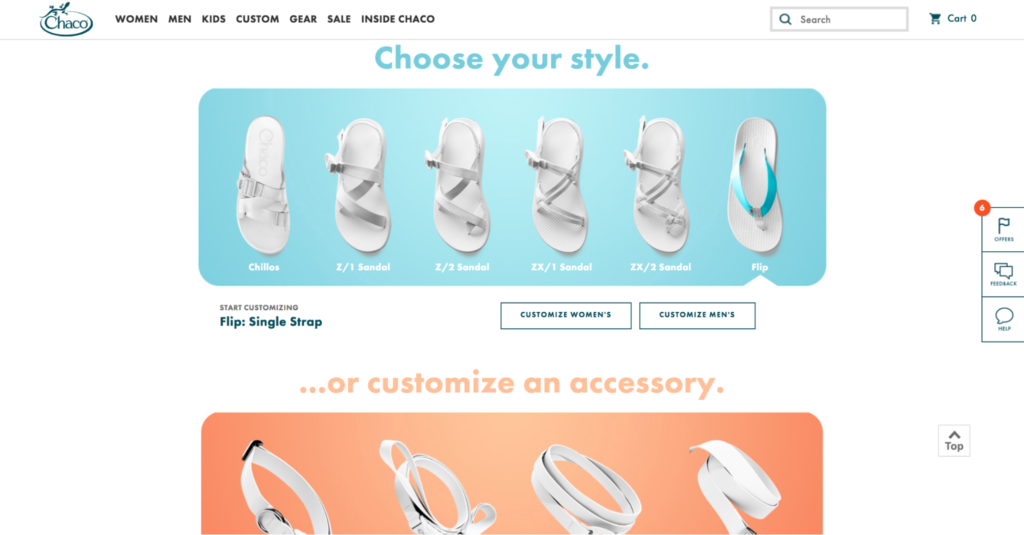

3. Tactical: Offer exclusive products

Offer products on your ecommerce site that are exclusive to you. Examples are shoes customized to the buyer’s feet, a unique hydration bottle design, a specially branded tent, or extended sizes (like Jon’s size 15 shoes) that can only be purchased on your site.

Why it works: Exclusive products create buzz, build demand, and show off your brand. This tactic avoids channel conflict with your retail outlets and other sellers. That’s because you aren’t directly competing against them, and you’re not undercutting them on price.

You’re simply offering a unique product; you’re keeping part of your production in-house, but there’s still plenty else to sell.

Chaco (see below) will make sandals to match your school colors. Retailers can’t carry every conceivable combination, but the manufacturer can. It’s a win-win-win situation.

NikeiD, an online service that lets customers create their own designs, is another good example. Want a custom Nike shoe? You’re going to have to go through Nike for that one.

Of course, providing product customization isn’t doable for all brands, but most manufacturers can provide a unique option only available on the brand site. You don’t have to go big to generate sales. You only need to be creative.

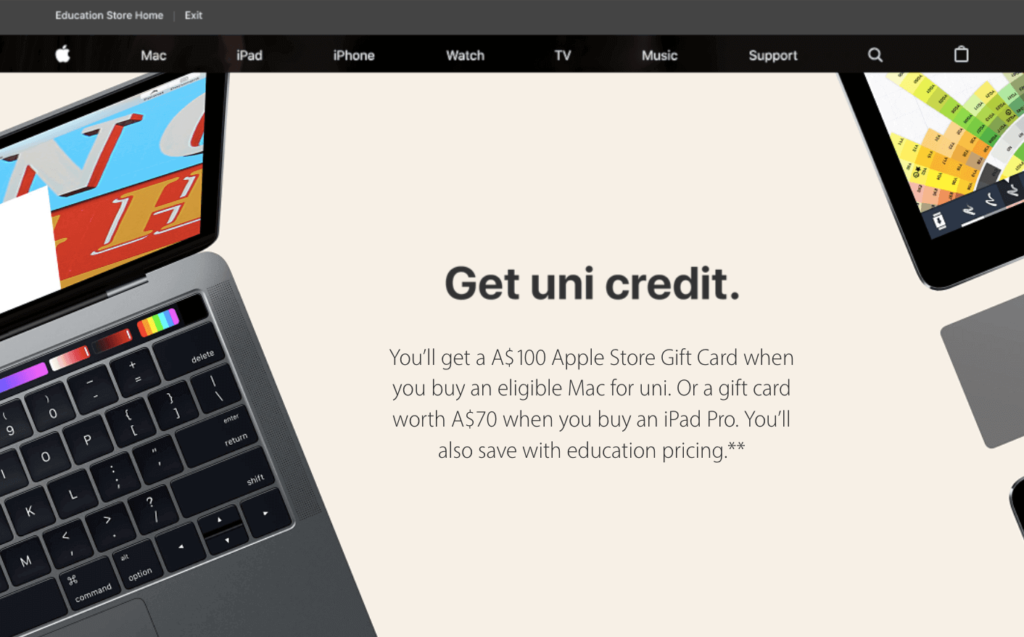

4. Tactical: Use bonuses (not discounts) such as product giveaways

Instead of authorizing a price reduction for retailers, offer a gift with purchase or some other add-on. For example, a free pair of socks with shoe purchase.

Why it works. Consumers love free stuff. With this tactic, you create value for your consumer (“Buy a ski jacket at the regular price, get your choice of gloves free”) without undercutting your retailers. Your fans will love it, and your entire sales channel will benefit from the added exposure and marketplace chatter.

It’s a win-win-win: The customer, the manufacturer, and the rest of the sales team all benefit.

It’s common knowledge Apple typically doesn’t offer discounts on their products. Nor do their retailers. What Apple does offer are gift cards with purchase (or an iPod some years) which they time up with specific buying seasons: beginning of the school year, holidays, and at the end of a product run.

Without explicitly offering a discount (which would tend to upset large box retailers), Apple can save their customers $100 and more on Apple products. And there’s nothing to stop retailers from doing the same thing. A variation of this tactic is to add on services or extend the warranty.

Another option for providing extra value without slashing prices is creating bundles and kits for your products. This can grow sales, help your customers get more of your goods, and allow you to (once again) discount products without the appearance of a discount.

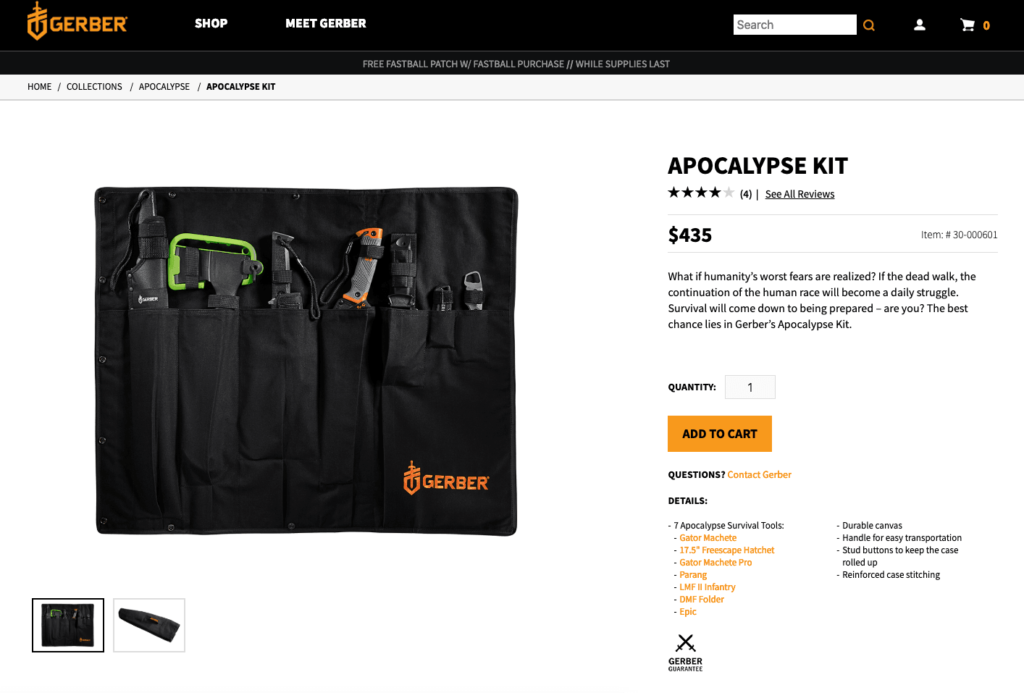

For example, check out Gerber’s apocalypse kit idea below.

The Gerber team once came up with the brilliant idea of bundling some of their most popular products into one kit for those who want to get ready for the “zombie apocalypse.” The kit, which retailed for $435, included six knives (that can be purchased separately), plus a zombie apocalypse carrying case to ensure buyers can easily take all their knives into the walking dead wilderness.

Let’s dive into some other ecommerce brands and how they’ve navigated multiple channels.

First-hand accounts of channel conflict from notable ecommerce brands

Below are three brands succeeding with their channel strategies. But you’ll notice something interesting here — none of them have the same approach.

One added Amazon as a channel, dropped it, and experienced more success sticking with DTC. Another started on eBay and added DTC later, along with a myriad of other channels. And the third built a notable DTC presence then added Target.

Why the conflicting stories? As you no doubt know, there’s rarely a one size fits all solution to big questions like these. So, instead of giving you a “7-step formula for channel conflict,” we’ve opted to provide something far more useful — context and stories that help you choose what’s best for your brand and customers.

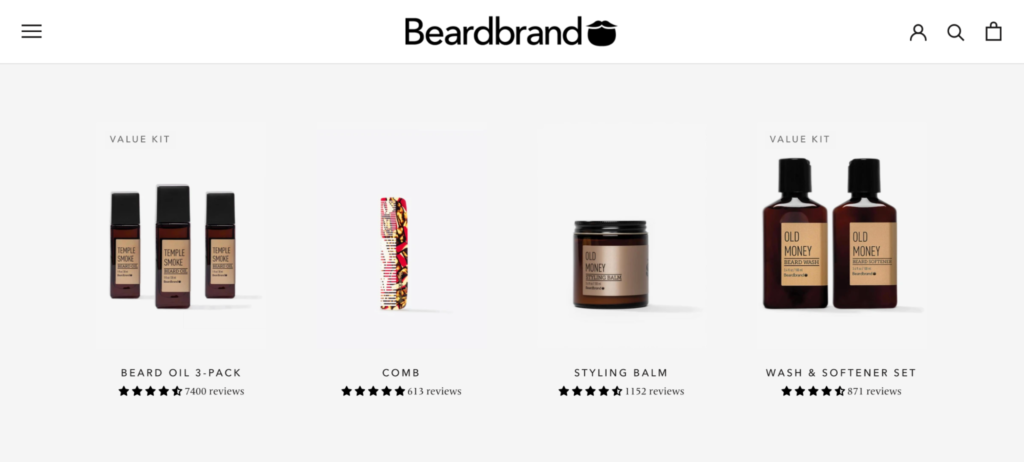

BeardBrand stopped selling on Amazon — and increased business 20%

A few years ago, you could find BeardBrand products on Amazon. In fact, Amazon sales made up about 10% of their business.

But if you Google “BeardBrand + Amazon” today, you’ll find this notice this page in the search results.

What changed?

Founder Eric Bandholz explains it came down to maximizing what BeardBrand does well, and that’s DTC — not selling through Amazon. “One of the lessons we’ve learned is you need to do the things you do well and continue investing in those things until you’ve maxed out your capacity,” he explained, “and then you pivot from there.”

Bandholz felt his team hadn’t maximized their own platform, beardbrand.com, so they stopped selling on Amazon and redirected resources to DTC.

It was a smart move for BeardBrand.

“Everyone says you have to be on Amazon and you’re leaving money on the table,” he noted, “but we actually found the opposite to be true.” Yes, they lost the 10% they were selling through Amazon, but that’s not the end of the story.

Ultimately, they saw a 20% increase in business.

Bandholz attributes this to:

- Less margin drain. Nowadays, the brand captures more sales direct (which are higher margin) as opposed to through a third party.

- Higher AOV. Because Amazon suggested similar or comparable products, a customer’s average order value on Amazon was about half what it was on beardbrand.com. Without those distractions, the DTC site brings in higher AOV.

So, would every brand see a similar 20% increase? Not necessarily. Here’s how Bandholz thinks about whether or not Amazon is a good distribution channel for an ecommerce store:

- Amazon is not a great fit if you’ve invested heavily in your brand, message, mission, and core values to sell your product. It’s difficult to effectively display those on Amazon.

- Amazon is a good fit if you’re more product-focused — if you differentiate by the product alone, not necessarily the brand. It’s also a good fit if many other retailers carry your product because if you’re not putting your product on Amazon, it’s likely one of your retailers will.

BeardBrand falls into the first category. They have video editors, an art director, influencers, and other creative talent they regularly work with to build the brand. “All those things are useless on Amazon,” Bandholz explains. “So those are resources we would be spending money on that wouldn’t be helping us grow on Amazon.”

And then there’s the expense of getting set up and driving traffic to the channel. That, as we mentioned earlier, is expensive. This is why Bandholz cautions other brand-heavy ecommerce leaders to consider moving off the platform, too.

“…more likely than not, the amount of sales you would be cannibalizing is far higher than the amount of sales you would be capturing on Amazon,” he cautions. “If you’re paying for ads, you might as well pay to drive people to your website and own that customer, own that address, own that data.”

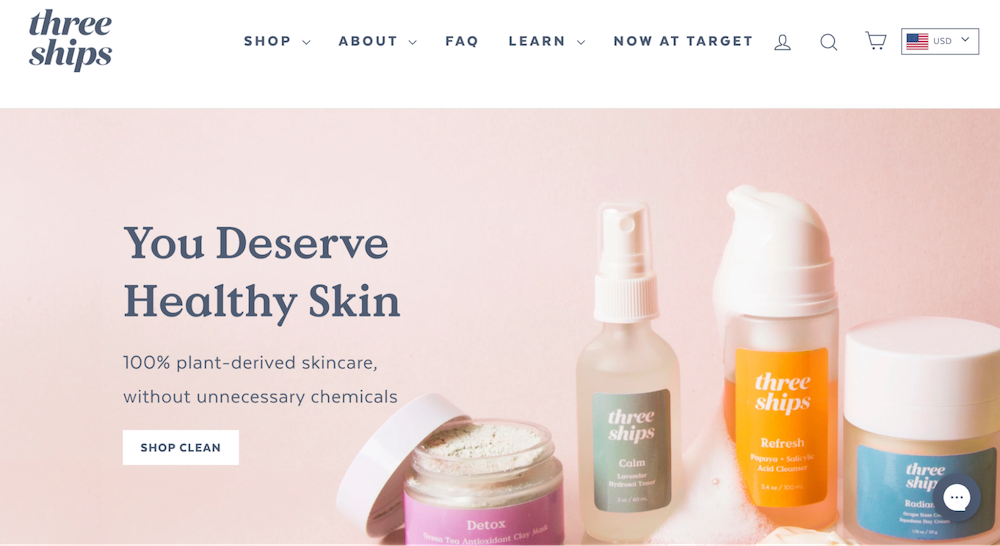

How Three Ships successfully launched at Target…in the middle of a pandemic

Three Ships started in 2017 with a chemical engineer, a business grad, $4,000, and an apartment kitchen.

That, by the way, was in Canada. And while the Three Ships team has successfully been growing their brand there, co-founder Connie Lo notes, “raising broad US awareness has always been a challenge, and at the forefront of our marketing efforts.”

So, they partnered with Target.

This made sense for several reasons:

- Target fit Three Ships’ customer base. Lo explained, “Target was our ideal partner not only for their broad reach in the US market, but also because our shopping demographic aligned perfectly (millennial women with average HH income +$80,000).”

- The retailer delivered recognition. Partnering with Target meant exposure and instant recognition for millions who shopped there weekly.

- Three Ships infrastructure could handle it. Lo and her co-founder didn’t go straight from the apartment kitchen to the Target Shelf. “After refining our brand, products, and supply chain over the past four years,” Lo says, “we finally felt ready to approach one of the giants. Waiting until our back-end could manage the inventory demands of Target was a huge part of our decision making process, and I’d recommend it for any indie brand looking to partner with a larger retailer.”

But Three Ships didn’t just launch with a retail giant (notable in itself!) — they launched with a retail giant in the middle of a pandemic when fewer Americans were walking through stores.

To deal with this curveball, Lo says they “pivoted from in-store marketing efforts like temporary price cuts (TPC’s at-shelf) and sampling, to focusing more on Target.com marketing.” Sponsored placements and enhanced product pages helped Three Ships capture the at-home shopper as well as boost sell-through.

As a result, Three Ships is reaching more of the American audience while also experiencing what Lo calls the halo effect — “we’ve had many mass retailers reach out (in both the US and Canada) after discovering us at Target, which has greatly benefited our distribution rollouts.”

Her advice to other ecommerce leaders considering a new channel?

- Have an established budget for it. A few months before launching at Target, Three Ships raised a seed round of $1.4 million. Lo says “we knew we wanted to invest in various marketing arms (e.g. influencer marketing, sampling, gratis, in-store promotions, Circle offers, in-store audits), and knew we would need capital to execute successfully.”

- Pitch your SKU price points carefully. “If I could go back, I would have proposed lower-priced SKUs to match the skincare brands we are carried next to,” Lo admits. Three Ships top sellers are ~50% higher in price point than the competition in-store. “Knowing that the general consumer is not able to discern the difference in ingredient cleanliness and quality in just a few seconds at-shelf,” Lo says, “I wish I had pushed back and either suggested our lowest-priced SKU’s or a smaller format.”

Enjoying this article?

Subscribe to our newsletter, Good Question, to get insights like this sent straight to your inbox every week.

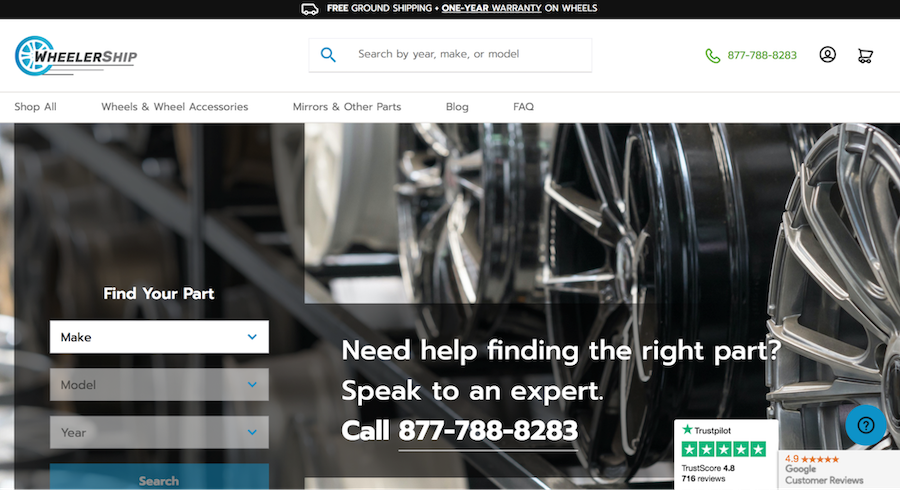

WheelerShip strengthens marketplace sales with DTC in a historically skeptical industry

WheelerShip a leading provider of factory-replica wheels and other automotive products.

And they have no shortage of ways to get those products to customers. Their channels include Amazon, eBay, a native DTC site, online wholesalers, drop-shipping…“We basically run three websites and two marketplaces in addition to our human sales structure,” Kate Cannova, Chief Business Officer explains.

Their journey isn’t conventional.

WheelerShip started (and continues as) a family shop in 2010. Their initial sales channel was eBay because it afforded the fastest ramp-up from not-selling to selling. At that time, WheelerShip could become an authorized seller, list good photos, and abide by the marketplace requirements with more ease than creating their own ecommerce store.

But to successfully combat the stigmas of the automotive industry, WheelerShip realized they needed a way to develop strong brand equity, and that (as Eric Bandholz from BeardBrand notes) wasn’t something the marketplaces were suited for.

“There is a lack of customer and consumer confidence in the industry altogether,” Kate explained, mentioning used car salesman tropes and idioms. To build credibility, WheelerShip pursued DTC in 2015. She says, “there was an impetus to feel more in control of the sales experience, to be paying less in fees, and to have to abide by other people’s rules less.”

Turns out, investing in DTC and brand integrity has strengthened their marketplace presence, as well as positively influenced the B2B side of their business. The B2C improvements, Kate says, are “having a pretty significant halo effect on the B2B side.” They’ve created a clear, beautiful, and straightforward user- experience on the wholesale side, which makes it easier for wholesalers to run their business. “And that means they come to us more frequently because it’s so much easier for them to track their invoices and manage their own shipping because they can easily see everything that they need to see in a very clear way.”

So, what can you learn from WheelerShip’s decade-plus experience with channel management?

Here’s Kate’s advice and caveats to other ecommerce founders:

- DTC <-> marketplace benefits aren’t a two-way street. While strengthening the WheelerShip brand with a DTC presence has encouraged marketplace sales, Cannova cautions those relationships aren’t a two-way street. Shoppers tend to stick with their preferred channels, and this means an eBay shopper rarely leaves eBay to purchase at wheelership.com.

- Understand the channel’s audience. “There is such a thing as an eBay shopper or an Amazon shopper,” Kate reflected. To succeed in a channel (as well as keep your sanity), you need to know the quirks of each type of shopper and how to meet them.

- Know the ROI of each channel. When you know the ROI, you can answer, is this channel worth keeping around? Cannova says ROI isn’t just a dollars, cents, and volume equation, either. “It’s also how many returns are we getting? What kind of condition is the product when it comes back? How much time are my customer care team representatives spending with Amazon communications…what really are we getting out of these experiences?”

- Don’t take certain things personally. You’re working hard to build a business, keep folks employed, and keep the lights on. And when you’ve invested so much in your brand, it can feel personal when someone returns a product, a marketplace grants a seemingly ridiculous claim, or you experience buyer fraud (Cannova has received everything from ceramic planters to Elvis memorabilia in “returns”).

- Accept some compromise. Hand-in-hand with the point above, you may not be able to stick to 100% of your company policies when you add marketplace channels. “There are rules Amazon and eBay have. If you want to sell there, you have to deal with those rules,” Cannova reminds store owners. This may mean accepting return merchandise or offering refunds you normally wouldn’t. While any form of compromise may initially feel weighty and stressful — as if you’re polluting the brand or customer experience — Cannova chooses to look at it another way. “What you’re doing is meeting people where they are and allowing them to shop in the way that feels comfortable,” she says. “And if you have to make certain adjustments to your internal policies to make that less anxiety-inducing — not just for your customer, but also for your team and your staff and yourselves — then that’s okay.”

- Consider trademarks. Per contract agreements, it’s not unusual for Amazon to allow competitors to sell off your listing. (Not only is this confusing for customers, but it can create serious headaches with returns and customer service!) However, trademarks can provide extra protection for your marketplace IP and brand integrity, including photographs and content.

Channel conflict can be a big opportunity for your brand

Conflicts are a normal part of running any business, including an ecommerce business. And adding channels beyond DTC doesn’t make sense for every brand or brand stage.

However, store owners looking to expand the ways they distribute can minimize potential conflicts by:

- Assessing whether new channels are a good fit for your brand before adding them

- Understanding the types of channel conflicts and why they occur

- Starting small and using watertight contracts

- Leveraging additional strategies like exclusive products and bonuses to keep retailers, customers, and your margins happy

- Listening to how other ecommerce leaders have navigated channels and learning from both their successes and failures

Channel conflict isn’t inevitable and it doesn’t have to wreck your sales or margins. With some careful planning and preparation, you can avoid it and maximize the benefits other channels offer.

Questions? Get in touch.

About the Author

Laura Bosco

Laura Bosco is a former Content Marketer at The Good and freelance writer. She helps translate thoughts, opinions, and client experiences into written products that are both entertaining and educational.