How to Improve Your Customer Acquisition Cost and Grow ROI

Do you know what it costs your company to convert a visitor into a customer? In this article we outline effective ways to lower these costs and optimize your return on investment.

Key Takeaways

By the end of this article, you should have the knowledge and resources to “check the box” in these areas…

- What customer acquisition cost is and why it’s a critical business metric

- How to measure and benchmark CAC for SaaS and ecommerce businesses

- The most effective ways to reduce your customer acquisition cost so your ROI is higher

What is your customer acquisition cost? It’s a powerful metric that can tell you a lot about the health of your business.

Every business school student learns there are only four ways to increase sales revenue:

- Get more customers

- Increase prices

- Increase the amount of the average transaction

- Increase the conversion rate of visitors to customers

Marketers condensed the formula by combining the last two tactics, and a prominent copywriter popularized the recipe as “The only three ways to grow any business,” but it’s not a new concept.

Get more customers, charge higher prices, and sell more to each customer… those are the basics of revenue growth, and that’s been the case since commercial transactions began.

It’s not the complete picture, though.

There’s another way to boost the bottom line. It’s a straightforward and sensible means of getting more ROI, but it sounds too much like accounting to get the notice it deserves. The method considers this question: Do you know what it costs to gain a new customer or client?

If you don’t know the answer, then reading this article and taking action on the suggestions could leave you smiling all the way to the bank.

What is a customer acquisition cost?

Customer acquisition cost, or CAC, measures how much a company spends to gain a new customer. In past decades, it was difficult to track how effective marketing and advertising campaigns were at gaining customers. But in today’s world of highly targeted ads and clear view of customer behavior, you can measure your CAC with accuracy in most cases.

And knowing your CAC helps your business to make smarter decisions about growth. Is it worth investing in that paid ad campaign on a social media platform? Is your website content paying off in sales? You won’t know until you measure your customer acquisition cost.

Total customer acquisition cost has many components:

- Cost of your sales team

- Cost of your marketing team

- Your ad spend

- Technical costs, especially for SaaS businesses

- Creative costs

- Inventory costs for ecommerce businesses

And lowering your CAC means you earn more from each transaction, increasing your profit margin and return on investment.

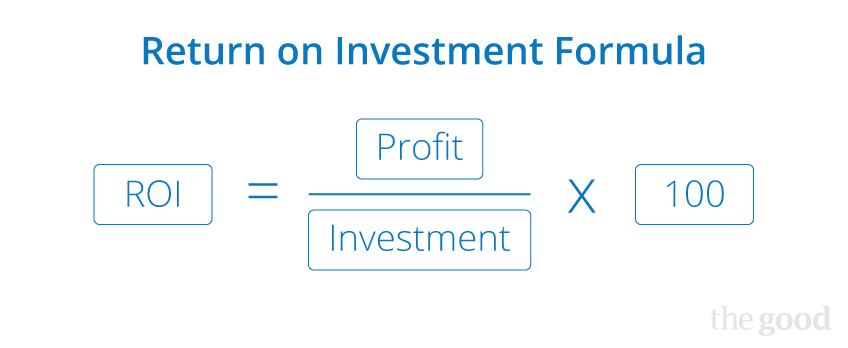

Use this formula to calculate your return on investment

Return on investment (ROI) is arguably the most important metric in business. It’s entirely possible for a company to get plenty of sales, but still lose money.

If it costs you a dollar to earn a dime, then your business is in trouble. Successful entrepreneurs never lose sight of the stock market adage “buy low, sell high.”

If you’re wondering how to improve ROI, reducing your customer acquisition cost can be very effective. Companies often focus on increasing sales, but devote little or only sporadic attention to cutting expenses. Everyone loves to feast, but few enjoy dieting. That’s a mistake.

This is where those fact-loving bookkeepers and accountants come in handy. The numbers they crunch can help keep you on track with your marketing strategies. Listen to them.

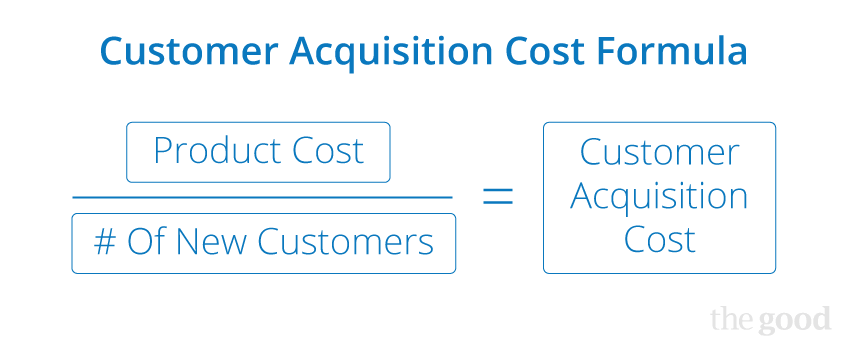

How to calculate customer acquisition cost

Calculating your customer acquisition cost (CAC) can be an eye-opening exercise, and it’s not a difficult task. The basic formula is to divide your total sales and marketing expenses for one month by the total number of new customers acquired that month (or whatever period of time you choose). That number is the amount of money it costs you to acquire one new customer.

CAC calculation can be broken down even further by marketing channels to understand what marketing initiatives are driving new sales and customers, and providing the lowest CAC and highest ROI.

Use this formula to calculate your customer acquisition cost

To leverage the CAC concept even further, calculate your average customer lifetime value (CLV). To do that, multiply the average yearly (or monthly) order total per customer times the number of years (or months) the average customer continues to order from you.

If your eyes are glazing over just thinking about those terms, don’t worry. We’re not going to take the math any further than we’ve already gone.

Our aim here is to talk about ways to lower the cost of acquiring a new customer. That will have a positive effect on ROI, no matter how closely you can calculate the metrics. It is good to have a reference point to monitor, though. To get started, all you need is a best-effort approximation.

Here’s what we’ve determined thus far:

- The higher your ROI, the healthier your marketing efforts, and thus business

- You should consider customer value in light of average total per-customer purchases over the buying lifespan of the customer (CLV)

- Lowering the customer acquisition cost is good for ROI

Let’s get specific about CAC for two industries where it really matters – ecommerce and SaaS businesses.

Cost of customer acquisition ecommerce

Ecommerce businesses need to calculate CAC accurately to ensure you’re not spending more to gain a customer than you’re receiving in profit – that means your business is unsustainable.

How much money do you need to earn from each customer to make your business profitable? Your CAC ecommerce will tell you that.

Average customer acquisition cost ecommerce

The average small ecommerce business spends about $58 to acquire a new customer, according to Shopify. But that figure varies widely depending on your industry, business size, and the type of customer you’re seeking.

For example, if you’re a luxury retailer, you’ll spend more to acquire your customers, but you can also charge more for your products, so your profit and ROI will be larger as well.

Ecommerce businesses can calculate a more accurate CAC by taking the cost of goods sold (COGS) into account – that is everything that goes directly into making your products, like labor costs and materials. Add those costs to your marketing spend, divided by your number of new customers, and you’ll have a more accurate CAC ecommerce number.

Reducing your ecommerce customer acquisition cost

If your customer acquisition cost in ecommerce is high, first you’ll need to uncover what is causing that imbalance. Digging into the data to discover whether it’s due to low conversion rates or pricey marketing is essential.

A good rule of thumb is to spend between 5-8% of your business’s total budget on marketing. If you’re exceeding that, look for ways to bring your spend down to lower your CAC. You can try to rely more on organic traffic sources and content, look for less expensive marketing platforms, and target potential customers better.

If you’re not spending too much on your marketing, but your CAC is high, the cause could be ineffective marketing and ads. Low conversion rates will also hurt your customer acquisition cost, so making your marketing work better without spending more money will reduce CAC and increase your ROI. More on these strategies is coming below!

Cost of customer acquisition SaaS

Customer acquisition cost is a vital metric for SaaS businesses (especially startups) to track and understand. Since the whole SaaS business model is based on customer lifetime value, knowing how much you’re spending to get a customer in the door helps you develop a sustainable pricing strategy.

Average customer acquisition cost SaaS

It’s difficult to cite a dollar amount for SaaS customer acquisition costs – different businesses have different pricing and cost models.

Instead, look at the ratio of your Customer Lifetime Value to Customer Acquisition Cost. If your LTV and CAC are equal, then you’re not making any profit – and your company is currently unsustainable. Ideally your LTV:CAC ratio would be about 3:1 so you’re getting three times more out of customers than you spend to bring them in.

Reducing your SaaS customer acquisition cost

Adding a customer referral program can be a great way to gain leads for SaaS companies without increasing marketing spend. Referral customers have a CAC of $0, so getting more of them over time lowers your overall acquisition cost.

User acquisition cost is another variable if you use some sort of freemium model. Are you spending a lot of marketing dollars to bring in users who don’t end up paying you anything? That can work if your paying customers have a high LTV, but keeping all these costs in balance is essential to sustainable growth.

One way to get more revenue out of your paying customers without increasing CAC is adding more value to your product – and ensuring those additions are what your customers truly value. You can determine what they would pay more for by simply asking them in surveys and focus groups and work to improve the customer experience.

And reducing churn in addition to marketing costs means you’ll spend less to acquire customers and keep them longer, increasing that LTV to CAC ratio even more. Increasing retention reduces the total cost you need to spend on gaining new customers, since you’re holding onto more of the ones you already have.

How to improve ROI and conversions

Your business is not like every other business, so there will be tactics you can use to lower CAC that wouldn’t work for other companies. This isn’t an exhaustive list – it’s simply a starting point to inspire you.

Let’s look at some of the most effective tactics ecommerce and SaaS businesses can employ to drive customer acquisition costs down and ROI up.

Get more organic traffic to your website

Organic traffic isn’t free, but it can be much less expensive than paid traffic. Let’s look at our prior example. If you can boost daily traffic with SEO from 40K to 50K while getting that 2% boost in CR, the numbers will look like this: 50K x 5% x $10 = $25,000. Increasing your conversion rate is lighting a fire under your revenues, and adding traffic is like adding fuel to that fire.

Those two tweaks more than doubled your daily revenue! Once again, you must consider the cost of making those changes when you compute monthly CAC, but the long-term result is likely to be impressive.

That’s why I love what we do at The Good. I get to see clients realize spectacular results from what seems like minor adjustments. No, I can’t guarantee working with us would double your revenue… but I’ve definitely seen it happen. Snow Peak saw a 149% increase in year-over-year revenue after working with us – check out their case study for details.

Want to tackle this task yourself? Listen to our Drive and Convert podcast’s breakdown on what traffic will look like in 2022 so you can set yourself up for success.

Write better copy

Stronger, more persuasive copy can be the catalyst for improved conversion rates, higher average sales, more frequent sales, better reviews, more referrals… the list goes on and on.

This is an area where you may need to forego your own opinions and the opinions of management. Don’t let the management or marketing team edit the power out of a copywriter’s work. Yes, even a broken clock is correct twice per day, but there’s a simple way to find out what works best: extensive testing.

Set up an A/B split test on a landing page to compare your copywriter’s suggestions to management’s edits. Test to see which works best. Make another change. Test again. Rinse and repeat.

If management consistently beats your writers, bravo! Maybe you need to invest in better writing. If writers beat management, heed the lesson. Every manager is not the wordsmith she fancies herself. Sorry to break the news, but it’s true – we see it all the time. Management interference may be a leading cause of insufficient sales.

Copywriting is an area where it’s possible to sharpen your CAC metric without incurring any additional expense. You’re already paying for the work. Just do what it takes to make it more effective!

Why customer acquisition cost is a critical benchmark

We’ve looked at the best three no-nonsense ways CAC first-aid can do wonders for ROI. There are other tactics you can employ, but these are the ones I like to look at first for ecommerce and SaaS companies.

Additional ideas are doing a better job of identifying your audience (which will help your copywriters construct more effective messaging), cutting down on excessive overhead expenses, getting customer service involved in the process, and decreasing the load time of your website.

Once you get enthused about tracking customer acquisition costs, you’ll see potential ways to hone your metrics further peeking out at you from every corner of the business.

Want more ways to level up your ecommerce skills, create more effective marketing campaigns, and hit your growth targets? Sign up for our Ecommerce Insights newsletter!

Enjoying this article?

Subscribe to our newsletter, Good Question, to get insights like this sent straight to your inbox every week.

About the Author

Jon MacDonald

Jon MacDonald is founder and President of The Good, a digital experience optimization firm that has achieved results for some of the largest companies including Adobe, Nike, Xerox, Verizon, Intel and more. Jon regularly contributes to publications like Entrepreneur and Inc.