How to Identify Your Most Valuable User Segments and Prioritize Accordingly

Are you building experiences for the users that will drive growth? Here’s how to focus your efforts where they’ll have the biggest impact.

Have you ever heard of the Pareto Principle? Even if the name doesn’t ring a bell, you’re likely familiar with the premise that 80% of revenue comes from 20% of customers.

Despite this being a proven economic model, companies are rarely focusing their effort on that 20%.

It’s not because they don’t want to; it’s because it is easy to get wrapped up in not losing a single sale, to the point that you are spreading yourself too thin.

If you focus your energy and product improvements on the highest-value user segment, you will see greater returns for less work.

In this article, we’re sharing the study we recently ran for a client that helped us identify their most valuable user segments and prioritize improvements to meet their needs.

What are user segments?

User segments are groups within a customer base who share similar characteristics, behaviors, or values.

They are created with user segmentation, which researches those commonalities and divides your audience into distinct groups. You can then tailor experiences, personalize messaging, and focus optimization efforts on their specific needs.

Common types of user segments

User segments can be divided based on different traits. The type of segmentation you use will vary based on your use case and goals. Here is a quick overview of common user segments.

| Segmentation Type | Description | Example Use Case |

| Demographic | Segments users by age, gender, income, education, etc. | Targeting campaigns for specific roles |

| Firmographic | Segments by company size, industry, revenue, or location | Tailoring features for SMBs vs. enterprise |

| Behavioral | Based on how users interact with your product, such as product usage, feature adoption, or login frequency | Identifying power users or at-risk users |

| Technographic | Segments by technology stack, device, browser, or OS | Prioritizing integrations or support |

| Needs-Based | Segments by specific problems or needs | Customizing messaging for value drivers |

| Value-Based | Groups by economic value (annual recurring revenue, lifetime value, subscription tier) | Prioritizing high-revenue customers |

| Lifecycle Stage | Segments by user journey (trial, active, churn risk, etc.) | Triggering onboarding or win-back flows |

| RFM (Recency, Frequency, Monetary) | Groups based on most recent activity, engagement frequency, and spend | Identifying loyal or dormant users |

| Acquisition | Based on the marketing channel or campaign source | Tailor messaging or personalize the experience |

Why companies optimize for the wrong segments

When we run prioritization exercises, one of the most common mistakes we see is companies focused on segments of users based on volume. If the segment has more users, they automatically believe it deserves more attention.

This reflects one of the three common prioritization mistakes:

- Volume bias: Prioritizing segments with the most users rather than the most value

- Squeaky wheel focus: Optimizing for the users who complain the loudest

- Recency fallacy: Focusing on the latest acquisition channel or user cohort without evaluating their actual value

The uncomfortable truth is that your most valuable segments may not be your largest, your loudest, or your newest.

Enjoying this article?

Subscribe to our newsletter, Good Question, to get insights like this sent straight to your inbox.

Conducting a segmentation study step by step

At The Good, we’ve developed a systematic approach to identify and prioritize your most valuable user segments. Here’s how it works.

Step 1: Set your goals

Before you start analyzing data, segmenting users, and prioritizing, you need a clear understanding of your project goals. In most cases, they will look something like this:

- Identify and quantify subsets of user segments based on use cases

- Understand the potential value of known segments

- Identify features and benefits that are most important on a per-segment basis

- Find opportunities to improve the engagement of high-value users

These goals can be turned into the key research questions of your study.

Step 2: Identify valuable behaviors beyond revenue

Your most valuable user segments, of course, need to drive revenue, but there are other indicators to consider when prioritizing who you are building/optimizing for.

Current value metrics, future value indicators, influence value, and cost-to-serve factors will all influence the overall value of a user segment.

- Current value metrics: Revenue generated, subscription tier, feature usage, team size

- Future value indicators: Growth trajectory, expansion potential

- Influence value: Referral behavior, advocacy impact

- Cost-to-serve factors: Support requirements, implementation complexity, churn risk, acquisition cost

Identifying and tracking these metrics and scoring segments based on this information will help paint a more holistic picture of value. Some segments might not be your biggest revenue drivers today, but they represent significant future opportunities, so you may choose to optimize for them instead of your current biggest spenders.

Step 3: Collect qualitative and quantitative data

Once you’re clear on goals and value metrics, you’re ready to start collecting data for your segmentation analysis. Gathering a multidimensional data set will help you better understand users as the complex humans they are. Types of data that will help your analysis will include:

- Usage patterns: Frequency, features used, time spent in the product

- Transactional data: Revenue contribution, plan type, upgrade/downgrade history

- Behavioral signals: Engagement with key activation points, referral behavior

- Acquisition source: Channel origin, customer acquisition cost, time to convert

- Demographic/firmographic data: Company size, industry, role

Most of this data will be sourced from your main quantitative collection tool, such as Google Analytics or your product analytics. But for a truly effective study, you need to supplement all this information with qualitative context. Surveys, session recordings, or user tests can help you better understand why your users are doing what they do.

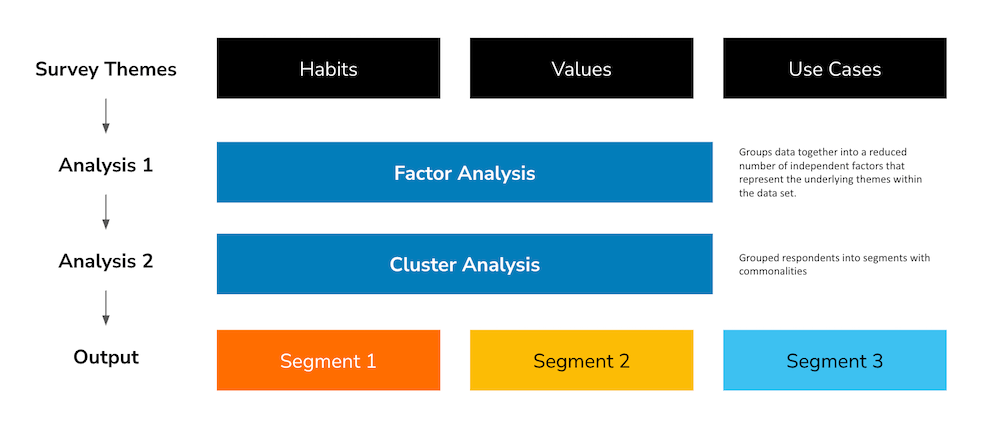

Step 4: Conduct factor analysis to identify value drivers

Group your data together into a reduced number of independent factors that represent the underlying themes within the dataset. This will help identify value drivers that differentiate your user segments.

For example, in a recent segmentation project, we discovered distinct value factors that formed natural segment groupings:

- Efficiency seekers: Primarily valued time savings and streamlined workflows

- Integration power users: Heavily utilized connections to other tools in their stack

- Data-driven optimizers: Focused on analytics and performance insights

- Scale-focused operators: Needed enterprise features and team collaboration

Understanding these value drivers helps you move beyond simple demographic segmentation to truly understand what motivates different user groups.

Step 5: Apply cluster analysis to form actionable segments

Once you’ve identified the key value drivers, use cluster analysis to group users with similar characteristics. Usually, 3-7 distinct segments emerge from the exercise.

These segments often cross traditional demographic lines, revealing unexpected patterns. For example, power users might not be enterprise customers as you assumed, but mid-market companies with specific workflow needs.

This is also the time to start looking for natural clusters of behavior that indicate high-value segments. Considering this, when you’re analyzing user clusters, look for key differentiators like:

- Usage frequency: Daily users vs. weekly vs. monthly

- Feature utilization: Which user flows are most common for each segment

- Value perception: What features each segment values most highly

- Growth potential: Which segments show increasing usage over time

Step 6: Quantify segment value and opportunity size

The inputs from your data, factor, and cluster analyses will produce outputs of your high-value segments.

Here’s an example of that workflow so far. The data (survey themes collected) on habits, values, and use cases were the inputs for the factor and cluster analyses. That resulted in segments around the frequency of product use, customer values, and reason for use.

For each potential high-value segment, revisit the value metrics you established in step 2 of the process. Calculate the relevant metrics to ensure you’re not just following hunches but making data-backed decisions about where to focus.

The most valuable segments often show strength across multiple metrics, not just in current revenue. For example, a segment with moderate current revenue but excellent retention and high referral rates may be more valuable than a high-revenue segment with poor retention.

You’ll also start to see how your most valuable segments differ from your hypotheses. Maybe it’s not defined by company size but by a specific usage pattern. As a specific example, imagine users who perform at least 3 exports per week AND invite 2+ team members within the first 30 days are 4.5x more likely to upgrade to the enterprise tier within 6 months.

This kind of insight could transform your priorities, focusing on making these specific actions easier and more intuitive, rather than spending time/money on creating new features for other segments.

Step 7: Map segments to specific opportunities

The final step is to leverage your knowledge about high-value users to focus optimization efforts. Now, you can connect your segment analysis to concrete optimization opportunities. A few thought starters for this process:

- What actions correlate with long-term success for this segment?

- Where do users in this segment typically struggle?

- What capabilities does this segment need but doesn’t have?

- What value propositions connect most strongly to this segment?

You’ll end up with a list of optimization opportunities. To prioritize those efforts and start building a roadmap, we recommend scoring them across these dimensions on a 1-10 scale, then calculating a weighted score that reflects your company’s specific situation and constraints.

- Potential revenue impact: How much additional revenue could optimizing for this segment generate?

- Implementation effort: How difficult would it be to implement changes for this segment?

- Time to results: How quickly can you expect to see meaningful outcomes?

- Strategic alignment: How well does focusing on this segment align with your long-term business strategy?

For example, if you’re under pressure to show quick wins, you might weigh “time to results” more heavily. If you’re planning for long-term growth, strategic alignment might carry more weight.

This will be the start of your roadmap for optimization efforts, ensuring that you focus resources on the right opportunities for your most valuable segments.

Focus on your highest-value segments first, then gradually expand your optimization efforts to secondary segments once you’ve captured the initial value. Always consider potential cross-segment impacts when making changes.

Drive growth with user segmentation and prioritization

As your product and market evolve, so will your user segments. What constitutes a high-value segment today may shift as you introduce new features or enter new markets.

We recommend evaluating your user segments quarterly, with a more comprehensive review annually or whenever you experience significant business changes.

Remember, the path to scaling your SaaS business isn’t through trying to please everyone with generic optimizations. It’s through deeply understanding which user segments create the most value and deliberately focusing your limited resources on enhancing their experience.

Ready to identify and prioritize your most valuable user segments? The Good’s Digital Experience Optimization Program™ can help you discover untapped growth opportunities through expert research, strategic insight, and data-driven experimentation. Contact us to learn more about how our team can help your SaaS business scale faster.

About the Author

Maggie Paveza

Maggie Paveza is a Strategist at The Good. She has years of experience in UX research and Human-Computer Interaction, and acts as an expert on the team in the area of user research.